Leaps in innovation, those moments in our history where tangible progress is made, are often the result of a layer of abstraction. For us to lay the foundations of the modern mathematics that we use today, it took an abstract notion, Zero – to quickly go from the painstaking use of the tangible countable things such as abacus when counting (and accounting) to the maths that modern civilisation is built upon.

Taking the paper out of documents by defining electronic document standards such as PDF, LaTeX and Openoffice, for instance, is one of the unsung innovations of our time.

There was a time when a server meant having a big and noisy crate mounted to a cabinet that’s stored somewhere in a cold and dry systems room: the invention of Virtualization abstracted this so that one can spawn a hundred servers at the touch of a button while sitting in a cafe with their laptop.

Once again, it took a layer of abstraction to massively expand the potential of this technology.

It was with this in mind that we went about solving the Point-Of-Sale hardware problem, the main problem being that a POS should not need separate hardware to begin with, apart from the poor implementation of several types of existing POS hardware.

We can’t wait to see what the sole trader and small business owner in Malta will do with it and we’re sure that the ingenuity of our market will surprise us in ways we’re not prepared for. Extending this to Berlin as our first step to expansion within Europe will give us even more behaviour to learn from.

And as we learn more from the market, we will evolve our service to retain maximum relevance.

That’s the challenge of the EMI – a constant cycle of innovation that sprints at the pace set by the market.

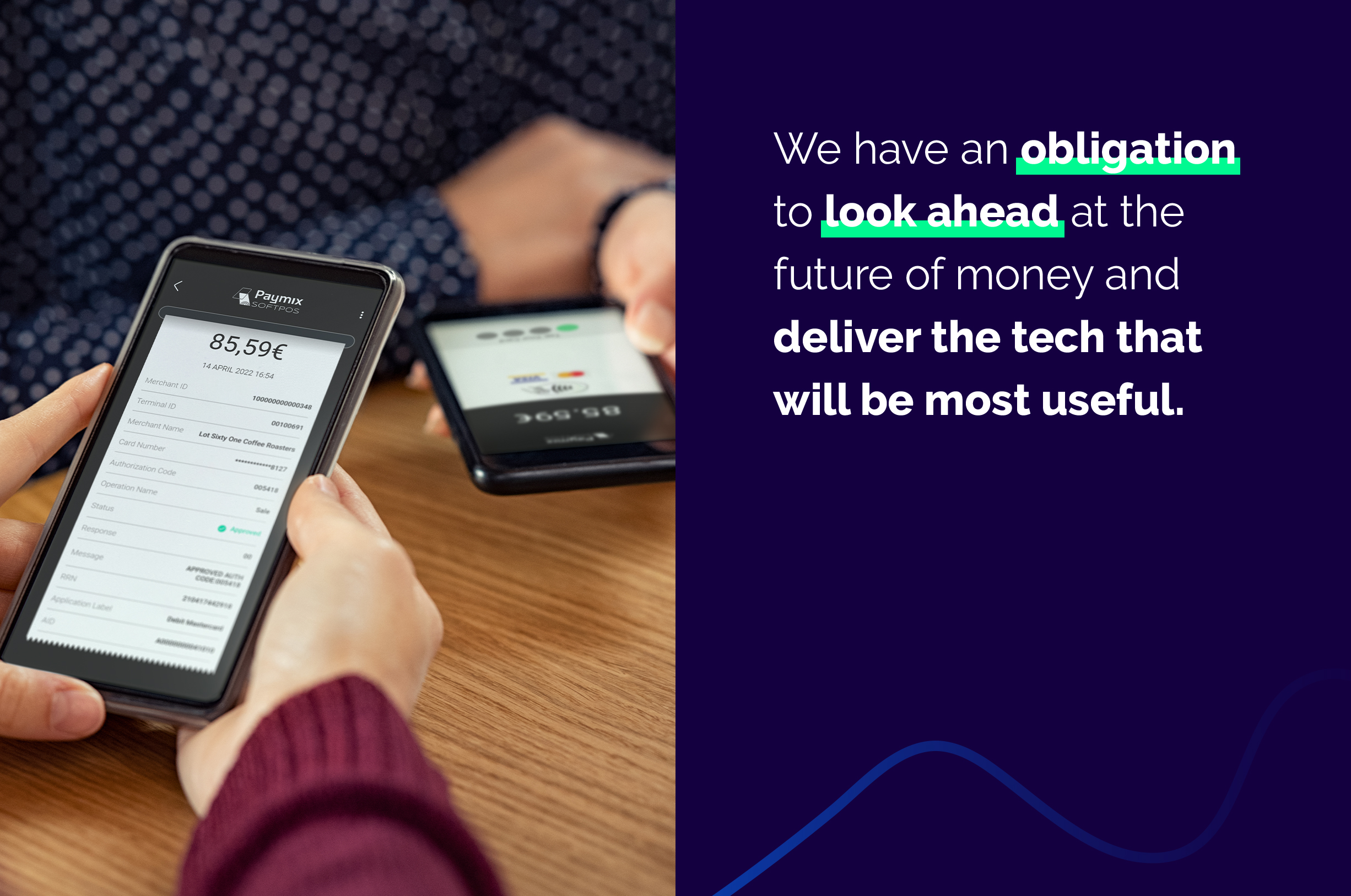

As an institution that is deeply concerned about helping end-users have a better, more convenient, and less costly interaction with their own money, we have an obligation to look ahead at the future of money and deliver the tech that will be most useful.

We look at the technology we develop in terms of ease-of-use, relevance to our users, lowest reasonable cost to our users, and universal acceptance.

It is in this spirit that we examined the technology that is out there, that we looked at what we have created so far, and devised a roadmap for the tech that we will be creating in the near- and medium-term.

An excellent case study for this approach is the Paymix SoftPOS.

First is the hardware itself. Electronic Point Of Sale machines (EPOS) have long been the bane of retail touch-points. They are a clunky add-on device that gets in the way of a smooth transaction. How often were you at a restaurant and asked to walk closer to the cash desk because their POS machine was out of range? How about those retailers that present three different POS machines and ask which bank card you’re using?

The various components for a POS transaction without a POS machine exist – they just haven’t been properly put together yet. As smartphones began to include near field communication (NFC) hardware, the tech we needed was becoming ubiquitous so we set about writing the code that would bring everything together.

Next we looked at the problem from a sociological perspective. Bigger businesses usually have multiple cash points across multiple retail locations. These are integrated with a rather costly Enterprise Resource Planning (ERP) package to keep track of transactions and make cash and electronic payment reconciliations easier.

But what about the sole trader and the small business? Can they afford the redundancy that multiple cash points provide? And are they ready or financially stable enough to invest in enterprise-grade resource planning software?

We also devised a system that would work in Malta. Malta is an excellent example of an advanced, cosmopolitan society with a very high population density. It is also the home of FIL – the parent company behind Paymix SoftPOS – so we felt we owe it to our home turf.

At no point did we consider Malta to be a test bed. Malta is a market with actual people making a living so we wouldn’t consider it as anything less – testing belongs in a lab and not in an active market. Our goal was to launch the minimum viable product in Malta first where we can be close to our clients, close enough to sit around a table with them and have a candid conversation.

But as early as next month, we’re launching Paymix SoftPOS in Berlin – a market as densely populated, as cosmopolitan, and as financially mature as Malta is. Of course, there are nuanced differences and there is a significant variation in scale but we have built our infrastructure to withstand the massive scaling up that this move will bring.

In tech terms, we wanted every phone to have the ability to turn into a point-of-sale machine.

In human terms, we wanted anyone to run their business with nothing more than the phone they already own. This represents the ultimate freedom and is consistent with our times.

The gig economy. The side hustle. The sole-trader. The solo artisan. The solopreneur.

The internet and social media made these possible and, for those who want it, it is a wonderfully liberating way of life. We set out to deliver all that’s needed for small businesses to get paid with minimum fuss, near-instant access, low transaction costs, and a relative freedom from the shackles of traditional banking.

At launch, Paymix SoftPOS works well – anyone with an Android phone (for now) can install the app and accept card payments using their phone. It takes a second to tell a customer that all they need to do is tap their card against the merchant’s phone. In the same way as we learned to use our cards in an ATM, this simple behaviour quickly becomes second nature.

The way we see it, it will be a short time before the traditional POS machine that we’re used to will become a relic.

But on the way there, we have plenty to do.

As with any tech that’s developed, we are in a constant cycle of review and optimization, adding features as we go along. We never see any of our products as ‘ready’ – we consider our tech as a living product that is just waiting to evolve into a more useful, more efficient, and more user-centric version of itself.

A speculative peek into the future tells us that we’re close to a time when even the tiny business owner will have access to a micro-ERP, a resource planning service that is completely integrated with their payments systems. At FIL, we are strong proponents of the notion of open banking so we see the future of both ideas as one that will inevitably converge.

We started by saying that leaps in innovation are often a result of abstraction, of examining a system that we’ve known to be good and removing everything that’s non-essential to its function. At the moment, we’re thrilled to be on the cusp of launching a revolution in payments, one that will give small businesses a giant leap forward in practicality, convenience, and cost-efficiency.